how much is my paycheck after taxes nj

What is 100k after taxes NJ. The New Jersey Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and New Jersey State Income Tax Rates and Thresholds in 2022.

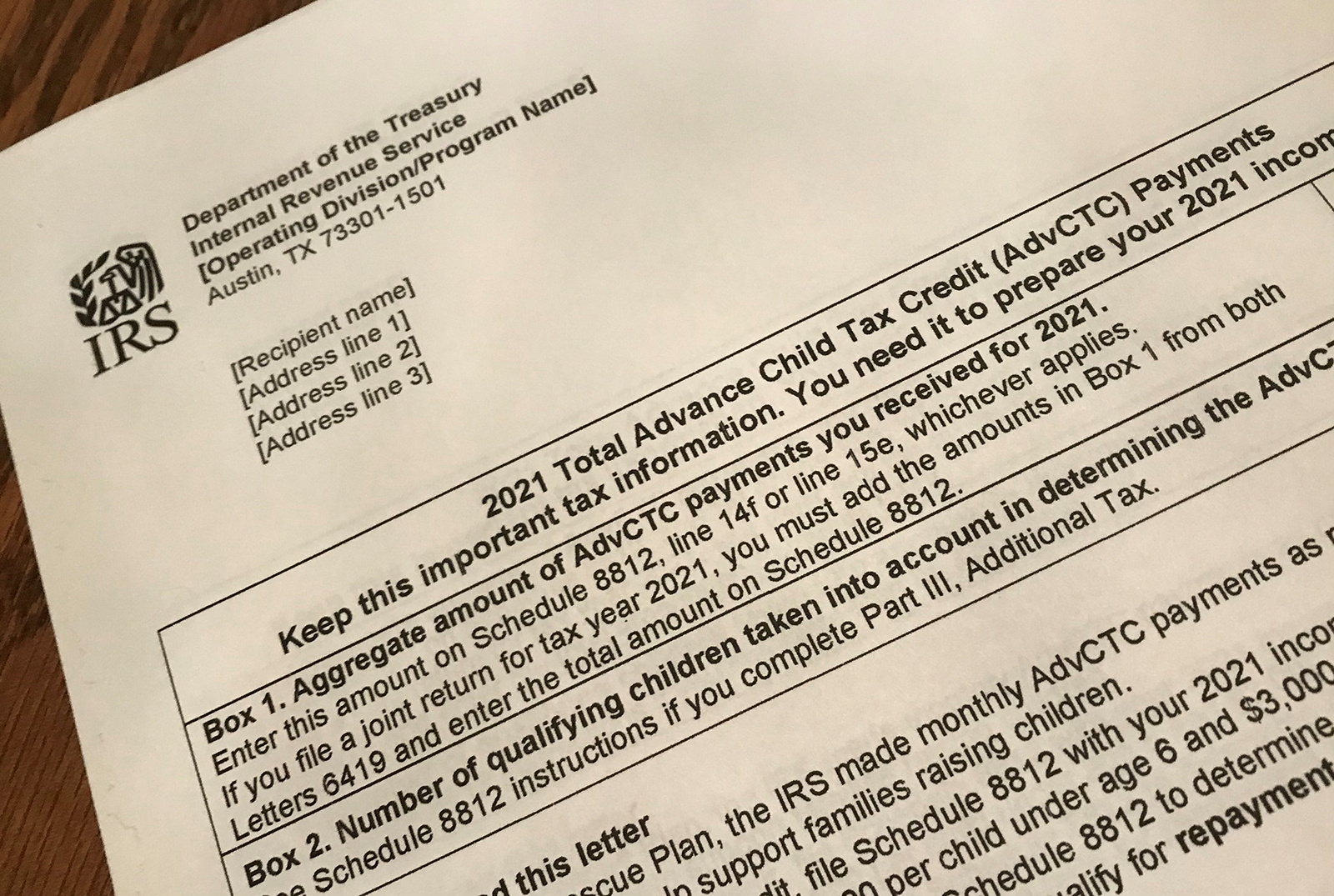

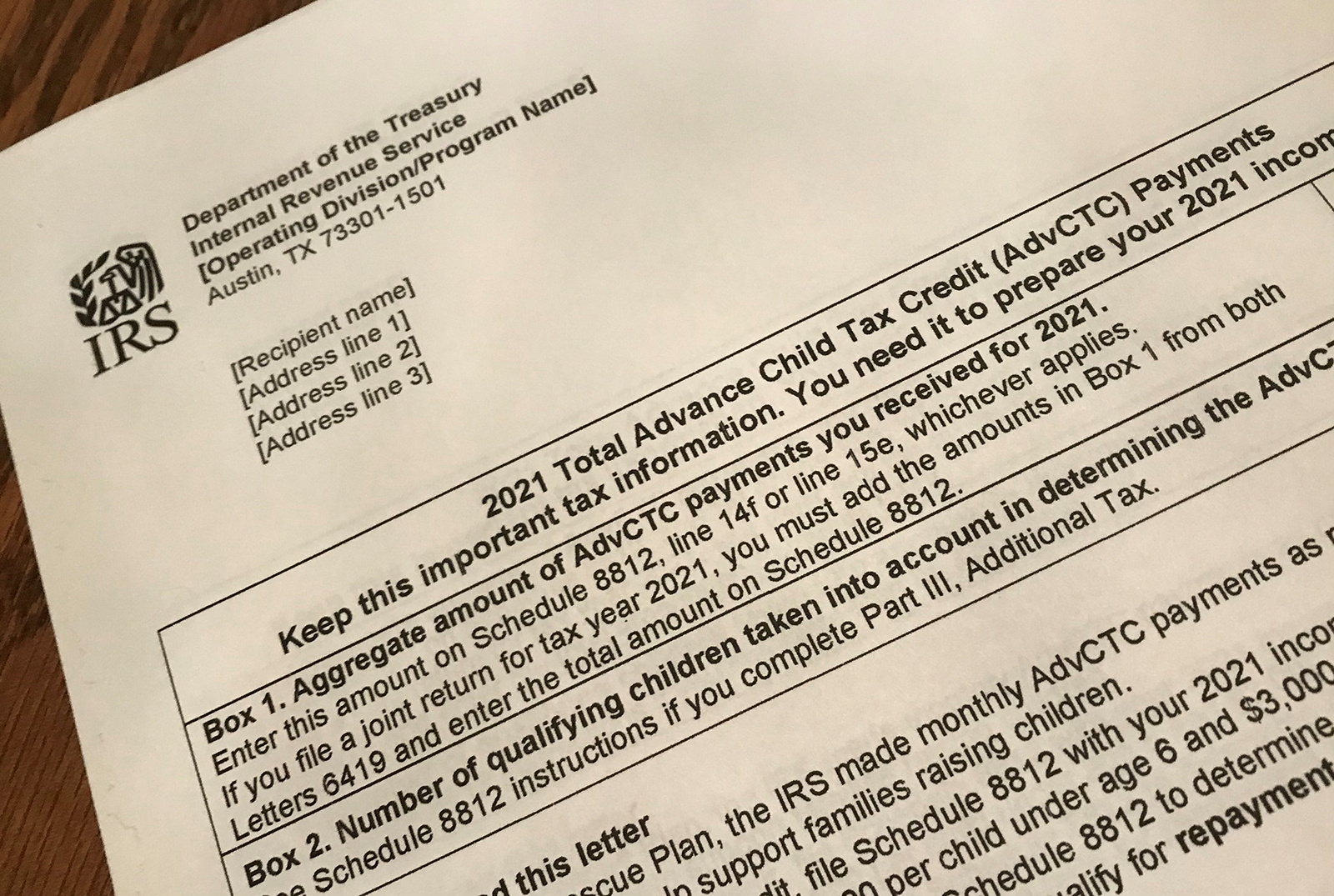

Aatrix Nj Wage And Tax Formats

In the Garden State a 100000 annual salary is mowed down to 71248 in take-home pay after federal and state taxes.

. Switch to New Jersey salary calculator. The share going to New Jerseys state income tax amounts to an estimated 461 of that six-figure income. After a few seconds you will be provided with a full breakdown of the tax you are paying.

For example if an employee has a salary of 50000 and works 40 hours per week the hourly rate is 500002080 40 x 52 2404. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. Detailed New Jersey state income tax rates and brackets are available on this page.

The standard deduction dollar amount is 12550 for single households and 25100 for married couples filing jointly for the tax year 2021. The take home pay for a single filer who earns 80000 per year is 6026695. Switch to New Jersey hourly calculator.

But assuming a 25 to 30 tax rate is pretty standard. New Jersey has a progressive income tax policy with rates that go all the way up to 118 for gross income over 5 million. Calculates Federal FICA Medicare and withholding taxes for all 50 states.

Use this calculator to help determine. To use our New Jersey Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

The amount you pay in taxes depends on many different factors such as where you live. New Jersey has one of the highest tax rates in the nation topping out at 897 percent. New Jersey Hourly Paycheck Calculator.

What is the payroll tax in New Jersey. What is the income tax in New Jersey. Filing 9000000 of earnings will result in of your earnings being taxed as state tax calculation based on 2021 New Jersey State Tax Tables.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for New Jersey residents only. - New Jersey State Tax. Next divide this number from the annual salary.

Please note this calculator. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. We take your gross pay minus 4050 per allowance times this percentage to calculate your estimated state and local taxes.

New Jersey Salary Paycheck Calculator. The new payroll tax law allows New Jersey municipalities to impose a payroll tax on businesses of up to 1 of wages. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

However the 62 that you pay only applies to income up to the Social Security tax cap which for 2021 is 142800 up from 137700 in 2020. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000.

After taxes with this tax rate your take-home pay would be approximately 47250. How much do you make after taxes in New Jersey. FICA contributions are shared between the employee and the employer.

It is not a substitute for the advice of an accountant or other tax professional. Taxpayers can choose either itemized deductions or the standard deduction but usually choose whichever results in a higher deduction and therefore lower tax payable. This New Jersey hourly paycheck calculator is perfect for those who are paid on an hourly basis.

That means about a third to a fourth of your income could go to taxes at 63000 a year. Supports hourly salary income and multiple pay frequencies. New Jersey income tax rate.

New Jersey payroll taxes include State Unemployment Insurance SUI and State Disability Insurance SDI. New Jersey Paycheck Quick Facts. Calculate your New Jersey net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New Jersey paycheck calculator.

How do I calculate hourly rate. This free easy to use payroll calculator will calculate your take home pay. You can alter the salary example to illustrate a different filing status or show an alternate tax year.

If you make 100000 a year living in the region of New Jersey USA you will be taxed 26613. Details of the personal income tax rates used in the 2022 New Jersey State Calculator are published below the. For 2018 these limits total 23759 with SUI accounting for 17356 and SDI at 6403.

62 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 62. The New Jersey income tax has seven tax brackets with a maximum marginal income tax of 1075 as of 2021. A bonus from your employer is always a good thing however you may want to estimate what you will actually take-home after federal withholding taxes social security taxes and other deductions are taken out.

Unlike federal or state income taxes there are annual limits on the amount of SUISDI tax an employee must pay. Even so New Jersey residents keep more of their income after taxes than the national average. Census Bureau Number of cities with local income taxes.

For a married couple with a combined income of 160000 per year the take home pay is 12144930. Tax brackets vary based on filing status and income. That means that your net pay will be 73387 per year or 6116 per month.

This allows you to review how Federal Tax is calculated and New Jersey State tax is. New Jersey 8500000 Salary Example. New Jersey State Payroll Taxes.

Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. This 8500000 Salary Example for New Jersey is based on a single filer with an annual salary of 8500000 filing their 2022 tax return in New Jersey in 2022. This results in roughly of your earnings being taxed in total although depending on your situation there may be some other smaller taxes added on.

Composing A Financial Contingency Plan Taxes Humor Emergency Fund Positive Mindset

Deluxe Paystub Paycheck Statement Template Doctors Note

New Jersey Nj Tax Rate H R Block

Net Paycheck Comparison I Got A Raise But Am Barely Seeing A Difference In My Net Pay R Moneydiariesactive

2022 Federal Payroll Tax Rates Abacus Payroll

Why Is N J Leaving 415m On The Table For Needy Children Editorial Nj Com

Solved I Live In Nj But Work In Ny How Do I Enter State

New Jersey Gift Tax All You Need To Know Smartasset

2019 New Jersey Payroll Tax Rates Abacus Payroll

Pin By Amanda Hintz Thomas On Life Federal Income Tax Payroll Teacher Treats

Bracket Creep Silent Killer Of Wage Earner Income Nj Spotlight News

2021 New Jersey Payroll Tax Rates Abacus Payroll

Aatrix Nj Wage And Tax Formats

Nj S Covid Waiver Of Remote Worker Tax Rule Ending Oct 1 Njbia New Jersey Business Industry Association

Aatrix Nj Wage And Tax Formats